5 Tips for Riding the Buzz: Successfully Trading Buzz Stocks

5 Tips for Riding the Buzz: Successfully Trading Buzz Stocks

Tackling buzz stocks can feel like a wild ride. These popular stocks often draw attention and excitement, but they come with risks. Understanding how to navigate this lively environment is key to making smart trades. Here’s how you can succeed in this niche.

The Allure and Danger of Buzz Stocks

Buzz stocks are typically fueled by hype and media coverage. Investors can be excited by trending news, influencer endorsements, or social media chatter. However, this excitement can quickly turn risky. Prices may skyrocket for little reason, then drop just as fast.

Defining “Buzz Stock”: Understanding the Phenomenon

A buzz stock is any stock that garners significant attention, often due to speculation, popularity, or sensational news. Think of it as a trending topic in the finance world. These stocks can have wild price movements, which may attract day traders but put long-term investors at risk.

Setting Realistic Expectations: High Risk, High Reward

Trading buzz stocks can lead to quick profits but also heavy losses. Setting realistic goals is essential. Understand that while a stock might seem hot today, its momentum can fade quickly.

Tip 1: Fundamental Analysis: Beyond the Hype

Digging Deeper Than Headlines: Evaluating Company Performance

Before jumping on the buzz, look at the company’s fundamentals. Check its earnings, revenue growth, and market position. Good fundamentals can help support stock price when hype fizzles.

Identifying Red Flags: Debt, Legal Issues, and Poor Management

Be cautious if you spot:

- High debt levels

- Ongoing lawsuits

- Management changes

These factors can surface hidden risks.

Example: Comparing Buzz with Fundamentals – Case Study

Consider a tech startup with a lot of buzz. If it lacks profits and has heavy debt, the hype might not last. Always balance buzz against solid data.

Tip 2: Technical Analysis: Charting Your Course

Reading the Tea Leaves: Chart Patterns and Indicators

Studying price charts can provide insight into market trends. Patterns like flags and triangles might show whether a stock’s price will rise or fall.

Volume Analysis: Identifying Buying and Selling Pressure

Look at trading volume. High volume can indicate strong interest, while low volume may signal fading excitement.

Risk Management Through Technical Indicators: Stop-Loss Orders

Use stop-loss orders to protect your investments. Set a predetermined price at which to sell. This strategy limits potential losses.

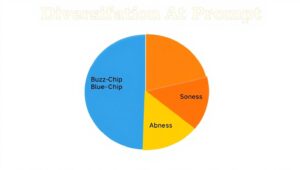

Tip 3: Diversification: Don’t Put All Your Eggs in One Basket

Portfolio Diversification: Spreading Your Investment Risk

Investing in only one buzz stock can be dangerous. Spread your money across various sectors. This way, if one stock falters, your overall portfolio remains stable.

Asset Allocation: Balancing Buzz Stocks with Stable Investments

Combine buzz stocks with more stable assets like blue-chip stocks or bonds. This balance can smooth out portfolio volatility.

Example: Diversifying Portfolio Allocation — Case Study

If you invest 20% in buzz stocks, allocate 80% in steadier investments. This approach helps cushion against wild market swings.

Tip 4: Emotional Discipline: Staying the Course

Avoiding Emotional Decision-Making: Fear and Greed

Trading can stir emotions. Fear of missing out can push you to buy, while panic can force you to sell. Recognize these feelings and manage them.

Importance of a Trading Plan: Sticking to Your Strategy

Create a sound trading plan outlining entry and exit strategies. Following this plan helps maintain focus amid market noise.

Expert Opinion: The Role of Discipline in Successful Trading

Many experts emphasize the importance of discipline. Sticking to your plan is often what separates successful traders from the rest.

Tip 5: News and Information Management: Staying Informed, Not Overwhelmed

Identifying Reliable Sources: Filtering Out Noise

With so much information available, it’s vital to seek reliable news sources. Stick to reputable financial websites and avoid sensational headlines.

Avoiding FOMO (Fear of Missing Out): Staying Disciplined

Don’t let fear of missing out drive your investment decisions. Stick to your research and analysis.

Utilizing Social Media Wisely: Filtering Hype from Substance

Social media can be a double-edged sword. While it’s a great tool for gathering information, don’t fall for every trending topic. Analyze information critically.

Conclusion: Mastering the Buzz: Key Takeaways for Success

Trading buzz stocks can be exhilarating, but it requires a strategic approach. Rely on fundamental and technical analysis while maintaining emotional discipline.

- Recap of Key Strategies: Balance your portfolio and stick to a well-defined trading plan.

- Long-Term Vision: Aim for sustainable growth over quick wins.

- Continuous Learning: Stay updated on market trends to make informed decisions.

Invest wisely, and you can navigate the buzz stock landscape successfully.

1 comment