Stocks

best stocks to buy, buzzing in my speakers, buzzing stock, buzzing stocks, buzzing trends, buzzing trends official, centrica stock, indian stock market, london stock exchange market open, stock market, stock market news, stock market news today, stock market today, stock to buy, stock to watch, stocks to buy, stocks to buy now, stocks to invest in 2017, stocks to watch, the stocks in action, top stocks to buy today, trending stocks, us stocks to invest in 2021

prasadamit225566

0 Comments

Introduction to Buzzing Stocks on 20 December

December 20th was a significant day in the stock market where there were huge movements among some key players. Dr. Reddy’s Laboratories and JSW Steel emerged as the top gainers of the day. However, Tech Mahindra and Axis Bank managed to be the biggest losers. This article takes an in-depth look at the dynamics of these stocks, factors that may be influencing their performance, and broader market trends of the day. We analyze these buzzing stocks with the hope of providing valuable insights to investors and traders navigating the ever-changing landscape of the stock market.

Overview of Stock Market Activity

The stock market on December 20 was a mixed bag as some stocks shot on the back of good fundamentals and positive market sentiment, while others went through headwinds that resulted in sharp declines. Let us look at the key performers for the day, starting from the top gainers.

Top Gainers: Dr. Reddy’s and JSW Steel

Dr. Reddy’s Laboratories: Performance and Analysis

The pharmaceutical giant, Dr. Reddy’s Laboratories, has been in the news for its impressive stock performance on December 20. The stock had gained significantly in value due to good earnings reports and positive industry developments.

Key Factors Behind the Rise:

Positive Earnings Reports: Dr. Reddy’s had come out with quarterly results that had revenue growth and profitability better than expected. This helped to boost investor confidence and led to buying activity.

Regulatory Approvals: The company was able to secure critical regulatory clearances for its new drug launches, which is expected to boost its revenue income in the coming quarters.

Market Sentiment: A general bullish view of the pharmaceutical space, as more people required healthcare solutions, also sustained the stock’s rally.

JSW Steel: Performance and Analysis

JSW Steel also turned out to be a star performer, with its stock gaining considerably. The resilience of the steel industry and the operational performance of the company helped it shine.

Key Factors Behind the Rise:

Strong Demand: An increase in domestic and international steel demand led to positive momentum for JSW Steel.

Operational Efficiency: The company reported improvements in production efficiency and cost management, enhancing profitability.

Positive Industry Trends: The worldwide interest in infrastructure development and eco-friendly energy solutions has supported the demand for steel, making it a positive factor for companies such as JSW Steel.

Major Losers: Tech Mahindra and Axis Bank

Tech Mahindra: Performance and Review

Tech Mahindra is among the leading IT service companies. The stock fell, which indicated that the investors were worried about its prospects in the short term.

Major Reasons for Declining:

Weak Guidance: The company issued weaker-than-expected revenue and profit guidance for the upcoming quarter, raising concerns about future growth.

Industry Pressures: The IT sector faced headwinds, including slowing demand for digital transformation services in certain markets.

Profit-Taking: After a prolonged period of strong performance, some investors opted to book profits, contributing to the stock’s decline.

Axis Bank: Performance and Analysis

Axis Bank, one of the key players in the banking space, also closed as one of the top losers. Market-wide issues and company-specific issues were well reflected in the stock’s performance.

Key Factors of Downtrend:

Credit Growth Anxiety: Credit growth was slower than expected with NPAs rising in the books.

Sector Pressures: Higher regulatory and macroeconomic pressures on the sector had impacted the performance of the bank stocks.

Market Volatility: Overall market volatility is a reason for the falling Axis Bank’s stock price.

Factors that Caused Stock Movement

There was a combination of macro, industry-specific, and company-specific factors that caused the stock to move on December 20. This is an important feature for investors and traders.

Market News and Updates

The global and domestic news events were the major driving factors behind market sentiment. Some of the most significant ones include:

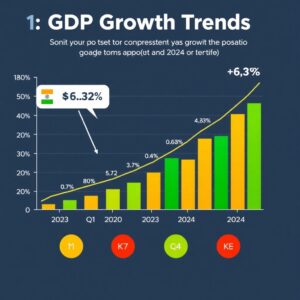

Economic Indicators: Positive GDP growth numbers and stable inflationary environment were supportive of the bull camp.

Geopolitical Events: Geopolitical problems have given a sense of uncertainty to the global markets, and it had instilled fear in the minds of investors.

Policy Announcements: The fiscal and monetary policy developments have also influenced the market, particularly in the interest-rate sensitive sectors.

Industry-Specific Factors

The sector-specific news has also played a role in the rise of the stocks:

Pharmaceuticals: Innovation in healthcare and regulatory approvals helped boost the sector.

Steel: Improved demand for infrastructure projects around the world has buoyed the steel industry.

IT Services: The slowdown in demand coupled with pressure from competitors have negatively impacted the IT industry

Banking: Concerns related to credit growth and asset quality impacted the performance of the banking stocks

Market Trends and Sentiments Analysis

Technical Analysis

Technical analysis enables investors to know and analyze trends for the making of right decisions. December 20th key technical indicators included:

Support and Resistance Levels: Dr. Reddy’s and JSW Steel broke key resistance levels, signaling bullish momentum.

Volume Trends: High trading volumes in these stocks indicated strong investor interest.

Price Patterns: Tech Mahindra and Axis Bank showed bearish patterns, reflecting negative sentiment.

Sentiment Analysis

Market sentiment on December 20 was mixed:

Bullish Sentiment: Positivity in pharmaceuticals and steel sectors helped sustain positive momentum for Dr. Reddy’s and JSW Steel.

Bearish Sentiment: Apprehensions over growth and headwinds from the macroeconomic front saw cautious sentiments in the IT and banking sectors.

Lessons for Investors and Traders

The stock movements on 20th December teach some vital lessons to market participants

Investment Strategies

Informed investors with a long-term focus can use insights drawn from the market trend of stocks as follows:

Portfolio diversification into sectors like pharma and steel

Shortlisting of sustainable growth sectors by analyzing company fundamentals and sectoral trends

Trading Recommendations

For December 20, take-home lessons for the short-term trader

Technical analysis to understand entry and exit points

News flow and sentiment tracking to capitalize on momentum trade

Entire Gainers and Losers list

Analysis of an elaborate list of gainers and losers provides a holistic view of market dynamics. It allows the investor to:

Understand the emerging trends across the sectors.

Assess individual stock performances against the trend of broader markets.

Conclusion and Recommendations

Summary of Key Findings

The stock market on 20 December reflected its volatile nature with Dr. Reddy’s and JSW Steel at the top and drops in Tech Mahindra and Axis Bank. Such fluctuations are determined by the company fundamentals and industry trends and broader sentiments of the market.

Investment Outlook

The key for investors and traders is to stay updated and agile. Participants can navigate the intricacies of the stock market by using market trend insights, technical analysis, and sentiment analysis. Whether it is capitalizing on the resilience of gainers or strategizing recovery plays for losers, informed decisions are the key to success.

Frequently Asked Questions (FAQ)

How can I track buzzing stocks like Dr. Reddy’s and JSW Steel?

Investors can use screening tools for stocks, check the financial news, and also follow the earnings reports for getting updated.

What were some factors that led to the performance of major losers such as Tech Mahindra and Axis Bank on December 20?

The key factors were weak guidance, industry pressures, and broader market challenges.

Is there any specific investment strategy suggested based on this analysis of market trends and sentiments of this article?

Diversify portfolios, monitor industry trends and use technical analysis for informed decision-making.

Post Comment