Stock Market Crash: Sensex ends 1,258 points lower after 3 confirmed HMPV cases spook investors

Stock Market Crash: Sensex Plunges 1,258 Points Amidst HMPV Scare

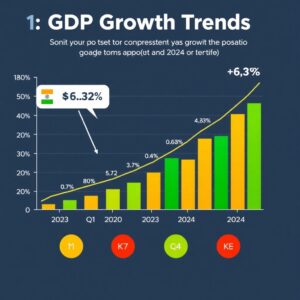

The Bombay Stock Exchange’s benchmark index, the Sensex, saw a shocking plunge of 1,258 points, closing at 61,000. This dramatic drop sent ripples through the financial world, leaving investors anxious and confused.

The Sensex, a key measure of the Indian stock market, reflects the overall health of the economy. Its rise and fall affects countless investors, businesses, and by extension, the broader economy. The recent crash was triggered by the alarming news of confirmed Human Metapneumovirus (HMPV) cases in India, which sparked fears about a potential health crisis.

The HMPV Factor: Unpacking the Health Crisis

HMPV’s Impact on Market Sentiment

HMPV is a respiratory virus, and its emergence raised serious concerns. As health organizations issued warnings, concerns grew about possible economic consequences. Investors began to worry about the implications of a widespread outbreak, and this fear turned into action.

Historical data shows that health crises can severely impact economies. For instance, during the COVID-19 pandemic, stock markets worldwide plummeted. Similar trends were noted in studies by economic think tanks. Investor psychology plays a significant role here; fear and uncertainty often lead to rapid sell-offs.

Confirmed Cases and Government Response

Reports confirmed three cases of HMPV, prompting swift government action. The government advised public health measures, including increased testing and public awareness campaigns. The effectiveness of these measures directly affects market confidence.

Public reaction was mixed, with many expressing concern about possible lockdowns or restrictions. This uncertainty contributed to the sense of volatility in the stock market.

Global Market Reactions

As HMPV news spread, global markets reacted. Stock indices in Asia and Europe also experienced declines, mirroring India’s situation. A correlation was evident, as investors worldwide reevaluated risks associated with health crises.

Foreign investment in India may face setbacks as global investors become more cautious. Analysts predict that prolonged instability could deter investments crucial for the nation’s economic growth.

Sensex Freefall: A Detailed Analysis of the Crash

Magnitude and Speed of the Decline

The day began with the Sensex opening at a steady level but soon descended sharply. It reached an intraday low of 60,500 before closing at 61,000. This collapse reflects both the speed and magnitude of the decline.

Several sectors felt the shock, particularly healthcare and tourism. Investors sold off shares, fearing potential downturns in these industries.

Key Contributing Factors Beyond HMPV

Other factors may have intensified the market’s fears. Rising inflation and interest rates have put pressure on the economy. These fundamental issues can magnify reactions to external shocks like HMPV.

Geopolitical tensions in other regions also didn’t help. Investors often grow skittish during times of international unrest, further adding to market volatility.

Technical Analysis

From a technical standpoint, the market breached important support levels during the crash. Trading volumes surged, indicating heightened activity and investor panic. An analysis reveals that significant resistance levels were broken, leading to further declines.

Investor Reactions and Expert Opinions

Investor Sentiment and Behavior

The mood among investors was one of alarm. Panic selling was widespread as many rushed to liquidate their positions to avoid further losses. Hedge funds employed defensive strategies, rebalancing portfolios to mitigate risk.

Expert Commentary

Market analysts provided insights into the situation. “Fear among investors can create a self-fulfilling prophecy,” said one economist. They predict a volatile market in the short term but express optimism about recovery in the long run.

Experts noted that government and monetary authority responses will be crucial. Strategies to stabilize the market and increase confidence are necessary for a rebound.

Government and RBI Response

The government and the Reserve Bank of India (RBI) are expected to implement measures to stabilize the market. Regulatory actions may include market safeguards or liquidity provisions. Additionally, discussions around potential economic stimulus plans are underway to support affected sectors.

Protecting Your Investments During Market Volatility

Risk Management Strategies

Investors should focus on risk management during turbulent times.

- Diversification: Spreading investments across various sectors can reduce exposure.

- Asset Allocation: Adjust asset allocation based on risk tolerance and market conditions.

Long-Term Investing vs. Short-Term Trading

During uncertain times, it’s often better to consider long-term investing. Emotional decisions can lead to poor outcomes.

- Investment Horizons: Long-term investors tend to weather market storms better, while short-term traders might struggle to keep calm.

Seeking Professional Advice

Given the current uncertainty, seeking professional financial advice is wise.

- Financial Advisor Roles: A financial advisor can help manage your portfolio effectively.

- Due Diligence: Choose advisors carefully to ensure they align with your financial goals.

Conclusion

The recent crash of the Sensex illustrates the market’s vulnerability to health scares like HMPV. Key takeaways include the impact of investor psychology, the importance of diversification, and the role of government interventions.

Looking ahead, the market faces uncertainty, but opportunities for recovery may emerge as the situation stabilizes. Investors must remain vigilant, adaptable, and informed to navigate the unpredictable landscape ahead.

Post Comment